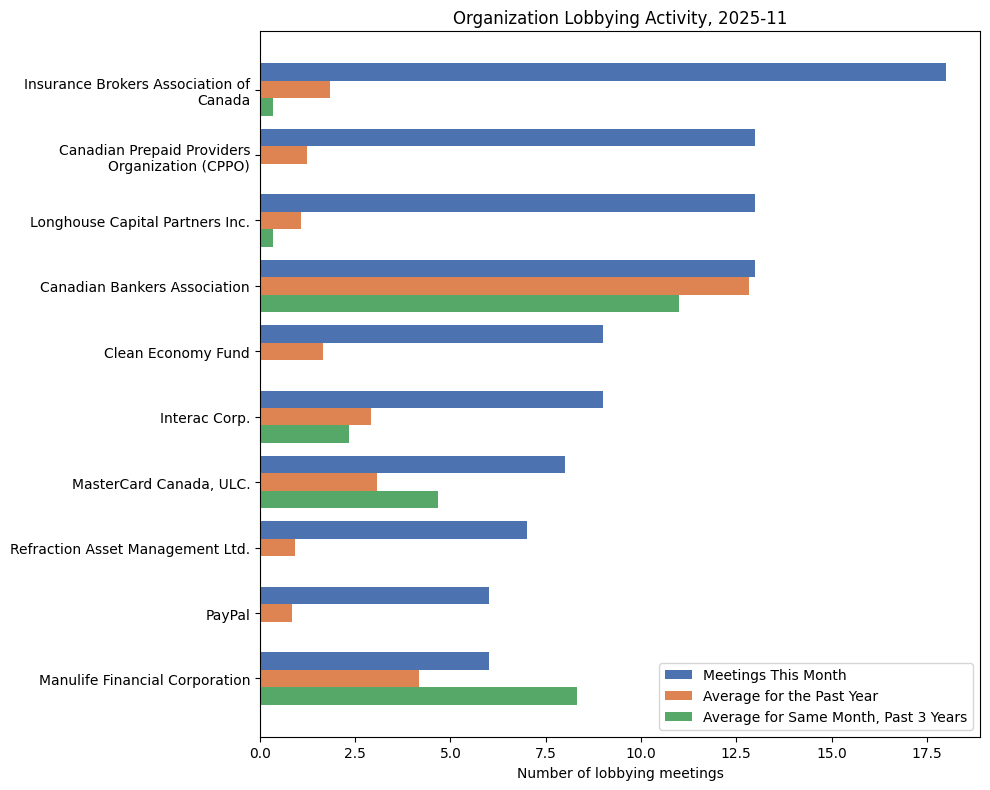

QSA's Week in Finance (#16, 2025)

G7 and G20 finance meetings conclude in Washington; BMO Life plans assumption reinsurance agreement; Safety National seeks asset release; Minister to hold G7 media callback; Updates from MPs and Senators on fiscal issues.

Good morning! Welcome back to Queen Street Analytics' weekly roundup of regulatory developments, legislative discussions, political announcements and other government-related news for professionals in the financial industry, banking, credit unions, insurance, payment processing, fintech, credit card issuing, asset management, venture capital, private equity, and crypto-currencies.

Every Monday, we break down the most important updates in this space in under five minutes.

Looking to elevate your organization’s presence or streamline your approach to government relations with more data-driven solutions? Queen Street Analytics is here to help you achieve your goals: faster, smarter, and more effectively. Let’s start the conversation. Reach us at contact@queenstreetanalytics.com to learn how we can support your success.

Start Date: 2025-04-20

End Date: 2025-04-26

Top Headlines

Main Stories

Minister of Finance concludes G7 and G20 Finance Ministers and Central Bank Governors Meetings in Washington, D.C.

On April 24, 2025, Minister of Finance François-Philippe Champagne wrapped up the G7 and G20 Finance Ministers and Central Bank Governors meetings in Washington, D.C. As part of Canada’s G7 presidency, Champagne co-chaired the G7 meeting alongside Bank of Canada Governor Tiff Macklem. Discussions addressed the current global economic outlook, changes in trade policy, and uncertainty in financial markets, as well as the ongoing situation in Ukraine. The meetings included sessions on macroeconomic risks, financial stability, and international financial architecture, with a separate focus on growth opportunities and challenges in Africa. The events took place alongside the IMF and World Bank Spring Meetings.

Sources: Announcements: www.canada.ca, Announcements: www.canada.ca

BMO Life Assurance Company seeks approval for assumption reinsurance agreement with Union Life

BMO Life Assurance Company has announced its intention to apply to the Superintendent of Financial Institutions for approval of an assumption reinsurance agreement with Union Life, Mutual Assurance Company. The transaction, expected to close on or after May 30, 2025, would see Union Life assume all risks associated with BMO Life's direct marketed life, accident and sickness, pre-needs life, participating life, and group retirement savings plan products in Canada. Policyholders may inspect the agreement and related actuarial report at BMO Life’s Toronto office for 30 days following publication.

Sources: Gazette, Part I: www.gazette.gc.ca

Safety National Casualty Corporation intends to seek release of Canadian assets

Safety National Casualty Corporation signaled its intent to apply for an order authorizing the release of assets maintained in Canada under section 651 of the Insurance Companies Act. The application to the Superintendent of Financial Institutions may proceed on or after June 2, 2025. Creditors or policyholders opposing the release have until June 2 to file objections with the Office of the Superintendent of Financial Institutions. The notice was issued from Toronto on April 19, 2025.

Sources: Gazette, Part I: www.gazette.gc.ca

Public Officials' Social Media

MP Michael Chong raises concerns about proposed government debt accumulation

MP Michael Chong commented on April 23 about the significant scale of debt proposed by former Bank of England governor Mark Carney, describing it as one of the largest non-emergency accumulations in history.

Sources: Social Media: x.com

MP Michael Chong discusses proposed debt accumulation in French

On April 23, MP Michael Chong reiterated in French that the proposed debt plan would represent a record level of non-urgent debt accumulation within a single term.

Sources: Social Media: x.com

MP Greg McLean addresses interest payments on government debt

On April 21, MP Greg McLean stated that Canada spends $53.7 billion annually on interest payments to banks and bondholders, and cautioned that this amount could increase if debt rises.

Sources: Social Media: x.com

MP Greg McLean discusses scale of annual interest payments

MP Greg McLean, on April 21, illustrated the magnitude of annual interest spending by comparing it to the cost of building multiple large hospitals each year.

Sources: Social Media: x.com

MP Salma Zahid references changes to RRIF withdrawals and GIS increases

MP Salma Zahid, on April 22, mentioned ongoing federal policies reducing the minimum withdrawal from RRIFs and increasing the Guaranteed Income Supplement.

Sources: Social Media: x.com

MP Jamie Schmale shares commentary on capital gains reinvestment proposal

On April 24, MP Jamie Schmale noted support for a proposal allowing Canadians to reinvest capital gains tax-free if the investments are directed to Canadian companies.

Sources: Social Media: x.com

Senator Amina Gerba discusses financial literacy with youth in Laval-Ouest

Senator Amina Gerba reported on April 22 about her engagement with youth regarding financial management, entrepreneurship, and wealth creation, as part of the SenGage program.

Sources: Social Media: x.com

Senator Tony Loffreda speaks at World Bank and IMF Parliamentary Network meetings

Senator Tony Loffreda participated in the World Bank and IMF Parliamentary Network meetings in Washington, highlighting Canada's stable banking system on April 22.

Sources: Social Media: x.com

Senator Stan Kutcher calls for use of frozen Russian assets in Canada to aid Ukraine

On April 23, Senator Stan Kutcher advocated for Canada to use frozen Russian assets held in Canadian banks to support Ukraine.

Sources: Social Media: x.com

What We're Reading This Week

- Volante Technologies announces general availability of next-generation ACH payment processing solution for financial institutions: Announcement on new ACH payment processing technology for financial institutions.

- Fighting Against Identity Theft Types: Loan or Lease Fraud: Overview of identity theft risks focusing on loan and lease fraud.