This Week in Mining — Washington (#5, 2026)

EPA extends CCR unit compliance deadlines; PHMSA seeks comment on Rockies Express Pipeline special permit; Trump revokes Endangerment Finding; NRC releases TRISO-X EIS and Wyoming regulatory notice; Montana, North Dakota coal program amendments finalized.

This is Queen Street Analytics' weekly digest of regulatory developments, legislative discussions and other government-related news concerning metals and non-metals miners, explorers and prospectors. Once a week, we break down the most important updates in this space in under five minutes.

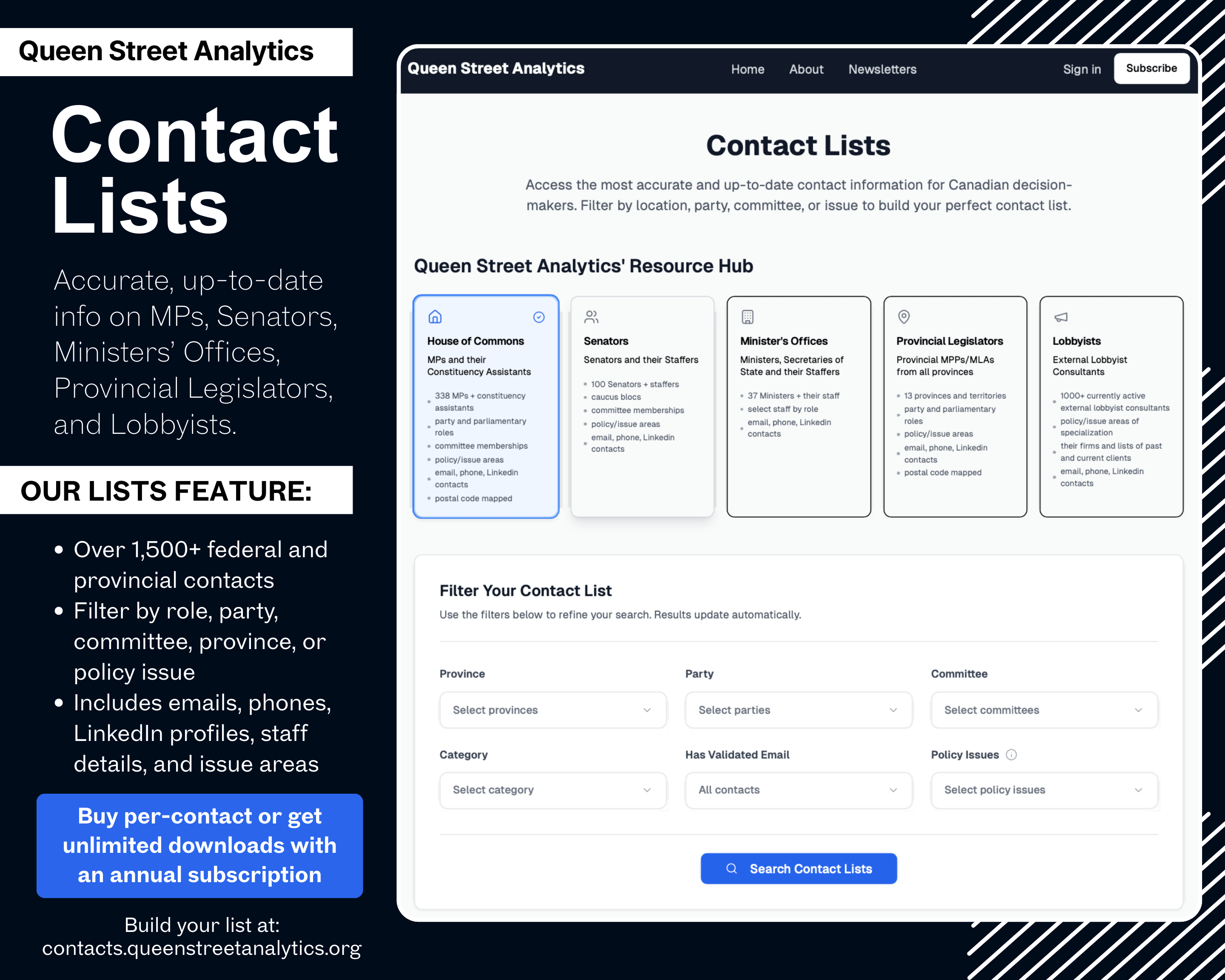

Want to track the upstream and downstream forces affecting Mining? Don’t miss this week’s updates in Manufacturing and Oil & Gas. Also consider subscribing to our Mining - Ottawa edition covering critical GR news north of the border.

Dates: 2026-02-08 to 2026-02-14

📋 In This Week's Newsletter

• 🇺🇸 Federal Government News

• 📜 Legislative Updates

• 📚 What We're Reading This Week

Federal Government News

EPA Extends Coal Combustion Residuals Compliance Deadlines

The Environmental Protection Agency finalized a rule extending compliance deadlines for coal combustion residual (CCR) management units under the Resource Conservation and Recovery Act. Facility Evaluation Reports for both part 1 and part 2 will now be due in February 2027 and February 2028 respectively, with groundwater monitoring system installation pushed to February 2031, allowing 36 months for compliance post-report. Associated deadlines for establishing CCR websites and closure care plans have also shifted, and the initial annual monitoring report now falls due in January 2032. The rule corrects errors from the 2024 Legacy CCR Rule and addresses industry challenges such as contractor shortages and seasonal conditions. EPA projects annualized cost savings of up to $27 million (7% discount rate), and the rule is effective immediately.

Sources: www.federalregister.gov

PHMSA Invites Comment on Rockies Express Pipeline Waiver Request

The Pipeline and Hazardous Materials Safety Administration requested public comments on a special permit application from Rockies Express Pipeline, LLC. The proposal covers the 2,866-mile natural gas transmission line, seeking permission to operate at an alternative maximum allowable operating pressure and consolidate prior waivers into current federal regulatory frameworks. Stakeholders are invited to review conditions and environmental assessments in Docket No. PHMSA-2025-0455, with submissions due by March 11, 2026. PHMSA will assess all feedback on safety, environmental, and operational parameters before issuing a decision.

Sources: www.federalregister.gov

Trump Administration Revokes Endangerment Finding

President Trump announced the repeal of the Obama-era Endangerment Finding, eliminating regulations that imposed over $1.3 trillion in costs across the economy. The action is expected to lower vehicle prices, reduce transportation costs, and expand consumer choices, while supporters claim it restores statutory authority and encourages energy independence. The decision closely follows renewed regulatory relief and is supported by representatives in the energy and manufacturing sectors.

Sources: www.whitehouse.gov

NRC Issues Final Environmental Impact Statement for TRISO-X Fuel Facility

The Nuclear Regulatory Commission published its final Environmental Impact Statement (EIS) for TRISO-X, LLC’s special nuclear material license application covering the TRISO-X Fuel Fabrication Facility in Oak Ridge, Tennessee. The facility is designed to produce high-assay, low enriched uranium (HALEU) fuel, with uranium enriched to below 20% U-235. Analysis includes construction, operation, and decommissioning impacts, and the NRC staff recommends approval unless new safety issues arise. The EIS draws from public comments, TRISO-X’s environmental report, and intergovernmental communications. The document is accessible through NRC’s ADAMS, regulations.gov, and local libraries.

Sources: www.federalregister.gov

NRC Proposes Regulatory Authority Transfer to Wyoming

The Nuclear Regulatory Commission seeks public comment on an amendment to its agreement with the State of Wyoming. If approved, Wyoming will assume regulatory authority over source material recovered from mineral resources processed primarily for purposes other than uranium or thorium. NRC's assessment finds the Wyoming program compatible with federal standards and adequately staffed. The scope specifies materials and activities Wyoming will regulate, while NRC retains authority over other radioactive materials. Comments are due by March 2, 2026.

Sources: www.federalregister.gov

Montana Coal Regulatory Program Amendments Approved

The Office of Surface Mining Reclamation and Enforcement approved Montana’s amendment to its coal regulatory program. The revision incorporates legislative and administrative rule changes regarding ownership/control, permit eligibility, and enforcement—addressing requirements named in Senate Bill 92 and multiple technical concerns. Changes span definitions, permit application procedures, eligibility reviews, and information updates within the Applicant Violator System, aligning state standards with federal equivalents under SMCRA.

Sources: www.federalregister.gov

North Dakota Coal Program Amendment Finalized

The Office of Surface Mining Reclamation and Enforcement published a final rule approving North Dakota's coal regulatory program amendment. The revision adjusts collateral bond definitions and adds conditions for real property pledged as collateral bond. Amendments bring state regulations into consistency with federal requirements under 30 CFR 800.5 and SMCRA, effective March 16, 2026.

Sources: www.federalregister.gov

FERC Receives Request for Well Drilling and Lateral Pipeline Installation in Oklahoma

The Federal Energy Regulatory Commission acknowledged a request from Southern Star Central Gas Pipeline, Inc. to drill a replacement well and install associated facilities at the Webb Storage Field in Grant County, Oklahoma. The project aims to ensure operational reliability in the storage field, with a project cost estimate of $8.5 million. Public interventions, protests, and comments are open through April 7, 2026, via FERC's eFiling or mail submission.

Sources: www.federalregister.gov

Legislative Updates

Critical Mineral Consistency Act of 2025

Bill 755, the Critical Mineral Consistency Act of 2025, was ordered to be reported, amended, by unanimous consent in the House. The bill targets energy sector regulatory consistency for critical minerals.

Sources: www.congress.gov

Reversionary Interest Conveyance Act

Bill 952, the Reversionary Interest Conveyance Act, was discussed in hearings by the House Energy and Natural Resources Subcommittee on Public Lands, Forests, and Mining. The bill addresses public lands and mineral interests.

Sources: www.congress.gov

EARA

Bill 677, EARA, underwent hearings in the House Energy and Natural Resources Subcommittee. The policy area focuses on government operations affecting mining and extractive industries.

Sources: www.congress.gov

ACRES Act

Bill 204, the ACRES Act, was reviewed in hearings by the House Energy and Natural Resources Subcommittee. The act covers public lands and resource access for mineral exploration.

Sources: www.congress.gov

Apache County and Navajo County Conveyance Act of 2025

Bill 1829, the Apache County and Navajo County Conveyance Act of 2025, was considered in House hearings on public land conveyance and mineral rights, with committee review ongoing.

Sources: www.congress.gov

LASSO Act

Bill 34, the LASSO Act, was presented during House subcommittee hearings. The legislation pertains to public lands management and implications for mineral and resource extraction industries.

Sources: www.congress.gov

What We're Reading This Week

- National Gear Repair, Inc. Addresses Critical Industrial Gear Manufacturing Needs Amid Supply Chain Challenges: National Gear Repair discusses meeting industrial gear manufacturing demand amidst supply chain disruptions.

- Canada and United States Rig Activity, E&P Earnings Calendar, 02/08/26: Rig activity and earnings calendar update for Canada and US covering February 8, 2026.

- This mineral makes your life run – and now it’s a trade issue: Rare earth minerals confront new trade concerns amid global supply chain shifts.

- White Gold Corp. Appoints Seasoned Mining Executive Donovan Pollitt as Strategic Advisor: White Gold Corp names Donovan Pollitt as strategic advisor to enhance mining operations.

- Exclusive: CME looks into launching first ever rare earth futures contract, sources say: CME Group explores launching rare earth futures contract, potentially adding liquidity.

- India in talks over critical minerals deals with Brazil, Canada, France, Netherlands, sources say: India negotiates critical mineral supply agreements with several countries.

- China to brief metals firms on rare earth export controls next month: China plans industry briefing on upcoming rare earth export controls.

- Can Africa win as the West and China scramble for minerals?: Africa’s mineral sector faces increased competition among global powers.

- Australian uranium miners in Namibia bullish on outlook as prices surge: Australian uranium miners operating in Namibia report optimism as uranium prices rise.