This Week in Finance — Ottawa (#2, 2026)

Canada-UAE trade partnership advances; Competition Bureau releases report on algorithmic pricing; satellite-based insurance for crops announced; StatsCan issues monthly credit aggregates data; Ontario bids for Defence, Security and Resilience Bank HQ.

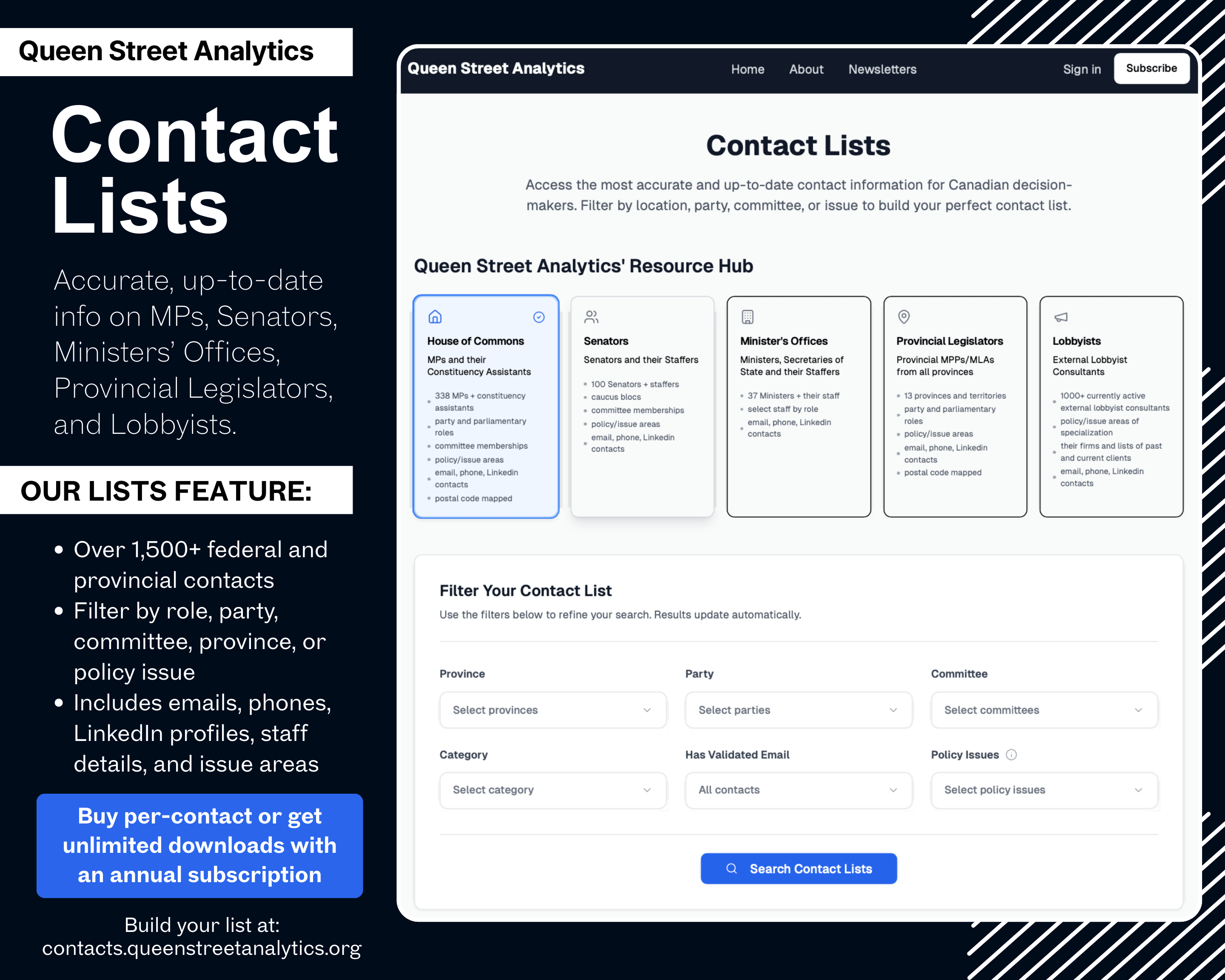

This is Queen Street Analytics' weekly digest of regulatory developments, legislative discussions and other government-related news for professionals in the financial industry, banking, credit unions, insurance, payment processing, fintech, credit card issuing, asset management, venture capital, private equity, and crypto-currencies. Once a week, we break down the most important updates in this space in under five minutes.

Want to track other GR news in adjacent industries? Don’t miss this week’s updates in ICT & Cybersecurity.

Dates: 2026-01-19 to 2026-01-25

📋 In This Week's Newsletter

• 🏛️ This Week's Parliamentary Calendar

• 🇨🇦 Federal Government News

• 🗺️ Provincial Government News

• 💬 Government Consultations

• 📚 What We're Reading This Week

This Week's Parliamentary Calendar

- Finance Committee meeting on Bill C-15, Budget Implementation, January 26: On January 26, the Finance Committee reviews Bill C-15, with Department of Finance officials scheduled to address income and business tax divisions, financial services, asset management, and financial crimes policy from 3:30 p.m. to 5:30 p.m.

- Access to Information, Privacy and Ethics Committee studies AI regulation, January 26: On January 26, the ETHI committee reviews AI regulatory challenges, with witnesses including Wyatt Tessari L'Allié (AI Governance and Safety Canada), The Human Line Project, Steven Adler, and Andrea Miotti (Control AI US, Inc.), from 3:30 p.m. to 5:30 p.m.

- Public Safety and National Security Committee reviews Bill C-8 (Cyber Security Act), January 27: On January 27, the SECU committee examines Bill C-8 related to cybersecurity with Minister Mélanie Joly and officials from the Department of Industry, scheduled for 3:30 p.m. to 5:30 p.m.

Federal Government News

Minister Sidhu concludes UAE trip, advancing Canada-UAE trade initiatives

Minister Maninder Sidhu wrapped up a business mission to the Gulf region, with a final stop in the United Arab Emirates, where strategic trade discussions occurred. The National Bank of Canada revealed plans to open an office in the Dubai International Financial Centre, and Novisto announced a new office in Dubai Silicon Oasis. Superheat registered its Middle East manufacturing entity in the UAE. A contract between Alexa Translations and Al Tamimi & Company was signed, focusing on AI-powered legal translation solutions. These moves align with Canada’s objectives to double non-U.S. exports over the next decade. Sidhu met senior UAE officials, including Sultan Ahmed bin Sulayem (DP World) and Khaled Al Shamlan Al Marri (Mubadala Investment Company). Engagements showcased Canadian expertise in AI, financial services, and infrastructure, with the Canada-UAE Foreign Investment Promotion and Protection Agreement and CEPA negotiations set to deepen trade ties. The visit is expected to facilitate expanded commercial cooperation in financial services and related sectors.

Sources: www.canada.ca

Minister Sidhu meets UAE Minister of State for Foreign Trade; Canada-UAE investment ties expand

During a visit to Abu Dhabi, Minister Sidhu met Thani bin Ahmed Al Zeyoudi, UAE’s Minister of State for Foreign Trade, joined by Canadian business leaders. Sidhu indicated strong Canadian interest in new trade partnerships, focusing on ICT, AI, clean technology, energy, and advanced manufacturing. Al Zeyoudi announced a forthcoming UAE delegation visit to Canada. Recent milestones between Canada and the UAE include: signed Foreign Investment Promotion and Protection Agreement; expanded Air Transport Agreement; and open negotiations toward a comprehensive economic partnership agreement. These actions support Canada’s goal to increase and diversify exports, with added opportunities for Canadian businesses operating across finance and technology verticals.

Sources: www.canada.ca

Competition Bureau publishes feedback summary on algorithmic pricing

The Competition Bureau released a report documenting feedback from over 100 organizations and individuals on algorithmic pricing and competition. Respondents included businesses, industry groups, legal experts, and consumer associations. Four primary themes were noted: algorithmic price-setting may increase market efficiency; there is potential for anticompetitive behavior; lack of data transparency presents risks for consumers and competition; and government regulation should carefully balance intervention and innovation. The summary is intended to inform regulators on evolving pricing technologies that could affect financial product pricing, credit card rates, insurance premiums, and securities trading platforms.

Sources: www.canada.ca

Monthly credit aggregates for November 2025 data published by StatsCan

Statistics Canada made monthly credit aggregates for November 2025 available, covering outstanding balances and flows by sector. This dataset provides comprehensive figures for consumer loans, mortgage lending, business credit lines, and broader financial transaction aggregates. Market participants may use this data to analyze sectoral credit trends, changes in consumer borrowing, and lending growth in relation to other regulatory disclosures.

Sources: www.statcan.gc.ca

Significant infrastructure investments and loan programs summarized for Ontario, 2025

Housing, Infrastructure and Communities Canada detailed substantial 2025 infrastructure investments impacting finance, insurance, mortgage lending, and asset management sectors. Approximately $3.29 billion was directed toward construction and renewal of nearly 30,000 homes. Over $309 million went to transit projects, while $173 million targeted energy-efficient and climate-resilient upgrades. $451 million funded housing-enabling water and waste systems, including $283 million for Toronto’s Black Creek sewer system, supporting construction of up to 63,000 homes. Loans from Canada Infrastructure Bank (CIB) amounted to $4.875 billion for clean power, transit, broadband, and Indigenous projects nationwide. In Ontario, the CIB provided $31.3 million for broadband infrastructure. These investments are shaping municipal housing finance and related asset growth in the region.

Sources: www.canada.ca

Provincial Government News

Ontario launches bid to host Defence, Security and Resilience Bank headquarters

Ontario and Toronto revealed their formal bid to host the newly created Defence, Security and Resilience Bank, citing financial sector expertise, global connectivity, and institutional support. The province pledged equity backing via the Protect Ontario Account.

Sources: news.ontario.ca

Alberta appointments and financial administrative action announced

Alberta named Andrew Boitchenko as Treasury Board member and authorized the Petroleum Marketing Commission to borrow up to $900 million for hydrocarbon marketing, with guarantees and loan activities approved under the Financial Administration Act.

Sources: www.alberta.ca

Government Consultations

Consultation ongoing for Canada-India Comprehensive Economic Partnership Agreement

Global Affairs Canada is inviting input through January 27, 2026, on priorities for a potential Canada-India trade agreement, including proposals affecting financial sector access and cross-border investments.

Sources: international.canada.ca

What We're Reading This Week

- 2026 Asset Growth: Why Federal Compliance Is the New Metric: Tracking federal compliance obligations emerges as a performance metric for fund managers.

- Fintech founders claim lawsuit launched by National Bank is effort to deter investors: Lawsuit between National Bank of Canada and fintech Flinks draws attention to competition issues in financial technology partnerships.