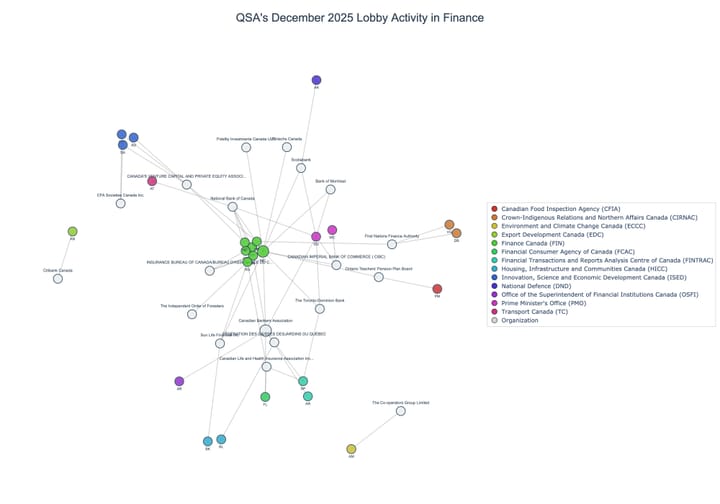

QSA's Week in Finance (#1, 2025)

CPP amendments impact pension benefits; BNY Trust seeks capital reduction; Capital gains tax hike stirs debate; Prorogation affects Climate Finance Act.

Start Date: 2025-01-04

End Date: 2025-01-10

Top Headlines

Main Stories

Canada Pension Plan Amendments Announced

The Government of Canada announced amendments to the Canada Pension Plan (CPP) effective January 1, 2025. These changes were part of the 2022–2024 Triennial Review. Key amendments include new child’s benefits for dependent children of disabled or deceased contributors attending school part-time, a top-up to the death benefit for contributors without a surviving spouse or partner, and extended eligibility for the Disabled Contributor’s Child’s Benefit when a parent reaches age 65. The amendments aim to address financial needs without altering the minimum CPP contribution rates. These changes may influence retirement planning and actuarial assessments within the financial sector.

Sources: ['Announcements: www.canada.ca', 'Announcements: www.canada.ca']